The Evolution of Impact Investing: From Religious Roots to Modern ESG

Impact investing has roots dating back to biblical times, evolving from religious principles into a modern investment strategy that combines financial returns with positive social change.

The practice began with Jewish law's concept of Tzedek (justice and equality) and Islamic Sharia-compliant standards like Riba, which prevented exploitation and banned interest payments. Both traditions established early frameworks for ethical financial practices.

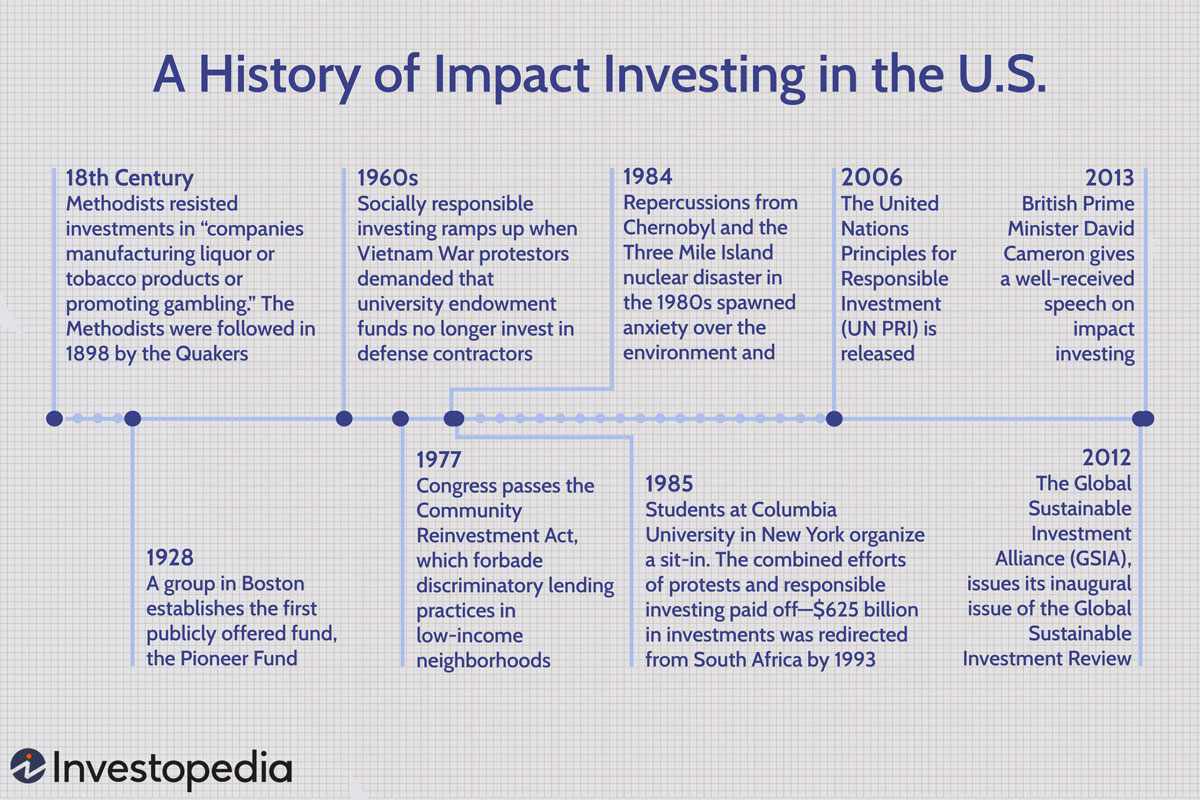

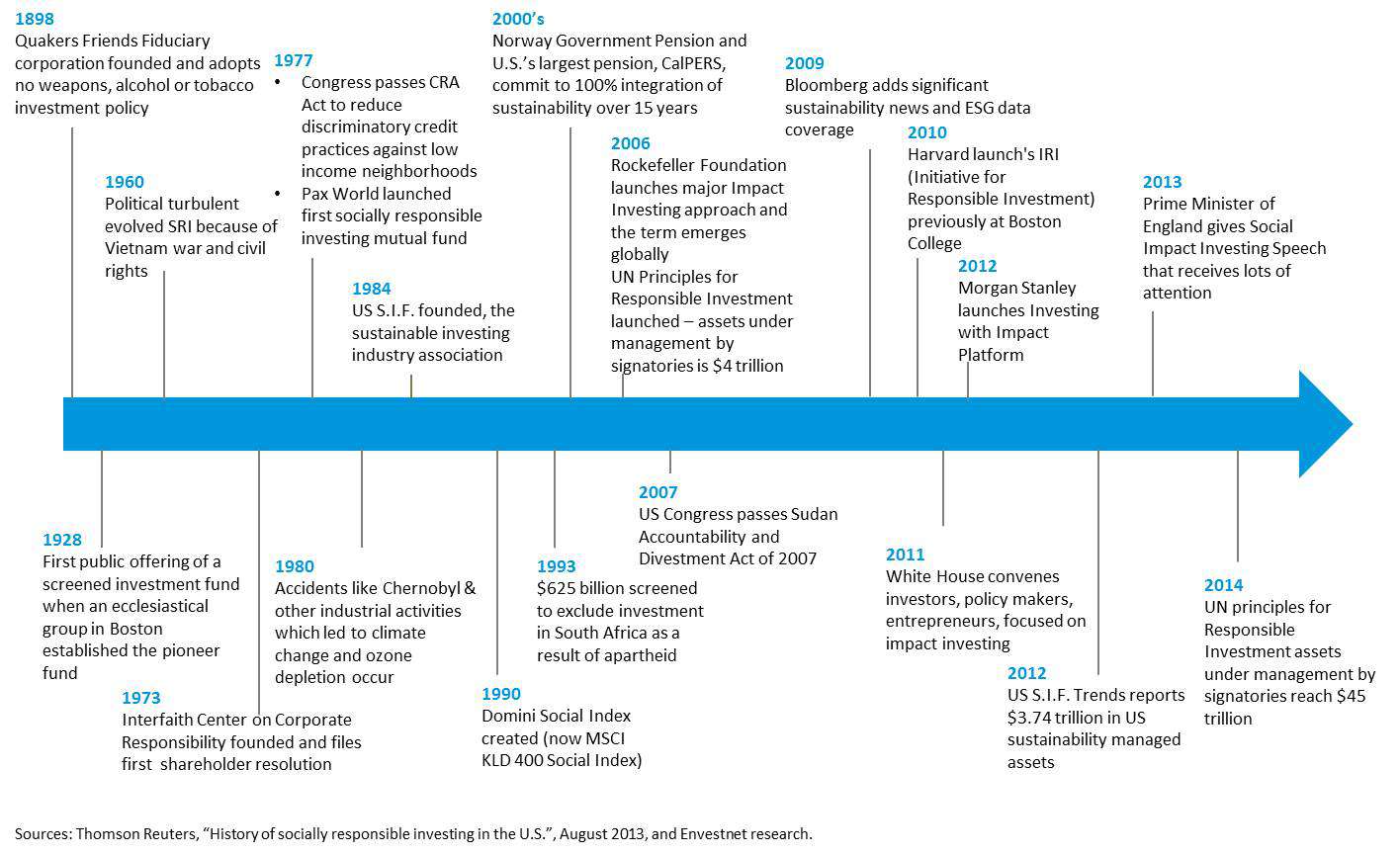

In the United States, socially responsible investing emerged through religious movements:

- 18th century: Methodists avoided investments in slavery, alcohol, tobacco, and gambling

- 1928: Pioneer Fund began implementing socially responsible strategies

- 1960s: Vietnam War protests led universities to divest from defense contractors

- 1980s: Anti-apartheid movement sparked widespread corporate divestment from South Africa

Timeline showing impact investment history

Major institutional milestones include:

- 1977: Community Reinvestment Act passed

- 1984: U.S. Sustainable Investment Forum launched

- 2006: UN Principles for Responsible Investment established

- 2012: Global Sustainable Investment Alliance formed

Timeline of responsible investing history

Modern impact investing focuses on:

- Environmental sustainability

- Social responsibility

- Corporate governance

- Diversity and inclusion

- Community development

Research shows that companies prioritizing ESG factors often deliver competitive returns while creating positive social impact. As of 2024, sustainable funds worldwide manage approximately $3.5 trillion in assets, demonstrating the growing mainstream acceptance of impact investing.

Common Questions:

- SRI vs. ESG: SRI actively excludes or includes investments based on specific criteria, while ESG evaluates environmental, social, and governance factors

- Profitability: 59% of studies indicate SRI investments perform as well as or better than conventional investments

- Impact: Successful cases like the anti-apartheid movement demonstrate how investor pressure can drive significant social change